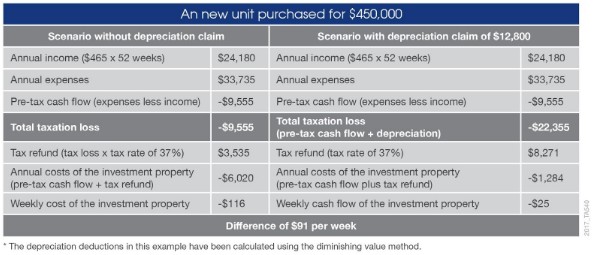

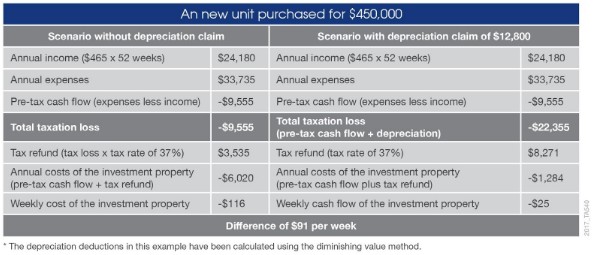

Donna purchased a new two-bedroom unit one year ago for $450,000. The property was rented for $465 per week with a total income of $24,180 per annum.

Expenses for the property including interest, rates and management fees totalled to $33,735.

After calling BMT Tax Depreciation, she found that she would be able to claim $12,800 in depreciation deductions in the first year.

The following scenario shows Donna’s cash flow with and without a depreciation claim:

Before claiming depreciation, Donna would experience a loss of $116 per week for the first year of ownership for her property.

Simply by claiming depreciation, Donna was able to turn her cash flow position into a more positive one and reduce her loss to just $25 per week. In total BMT Tax Depreciation were able to save this investor $4,736 in just the first year.

*Under proposed changes outlined in draft legislation (section 2 of Treasury Laws Amendment Bill 2017), investors who exchange contracts on a second hand residential property after 7:30pm on 9th May 2017 will no longer be able to claim depreciation on previously used plant and equipment assets. They can claim deductions on plant and equipment items they purchase and directly incur the expense. Investors who purchased prior to this date and those who purchase a brand new property will still be able to claim depreciation as they were previously. Investors should note that these changes are not yet law, as the legislation still needs to be passed through the senate for confirmation. BMT Tax Depreciation remain in discussion with government around the new changes and will keep our clients informed on the outcome. To learn more visit www.bmtqs.com.au/budget-2017.**Case studies and figures are based upon tax depreciation schedules completed by BMT Tax Depreciation and do not represent any particular person or investment property scenario. The information provided is a general guide and does not constitute financial, legal or taxation advice. All figures are supplied as examples and may not represent your personal circumstances.You acknowledge and agree you must undertake your own analysis and obtain independent legal, financial and taxation advice before using, relying or acting on any information supplied on this website.Neither BMT Tax Depreciation, nor its Directors, Shareholders or Advisors make any representation or warranty as to the accuracy or completeness of information found in these typical examples. Nor will they have any liability to you or any other party for any representations (expressed or implied) contained in, or any omissions from, that information.

Article provided by BMT Tax Depreciation.

Bradley Beer (B. Con. Mgt, AAIQS, MRICS, AVAA) is the Chief Executive Officer of BMT Tax Depreciation.

Please contact 1300 728 726 or visit www.bmtqs.com.au for an Australia-wide service.