Important Update: New Seller Disclosure Requirements from 1 August 2025

From 1 August 2025, a new statutory Seller Disclosure Regime will take effect across Queensland as part of the implementation of the Property Law Act 2023. This legislative reform is designed to enhance transparency, reduce contract disputes, and ensure that buyers receive vital information about a property before entering into a contract.

What Does This Mean for Sellers?

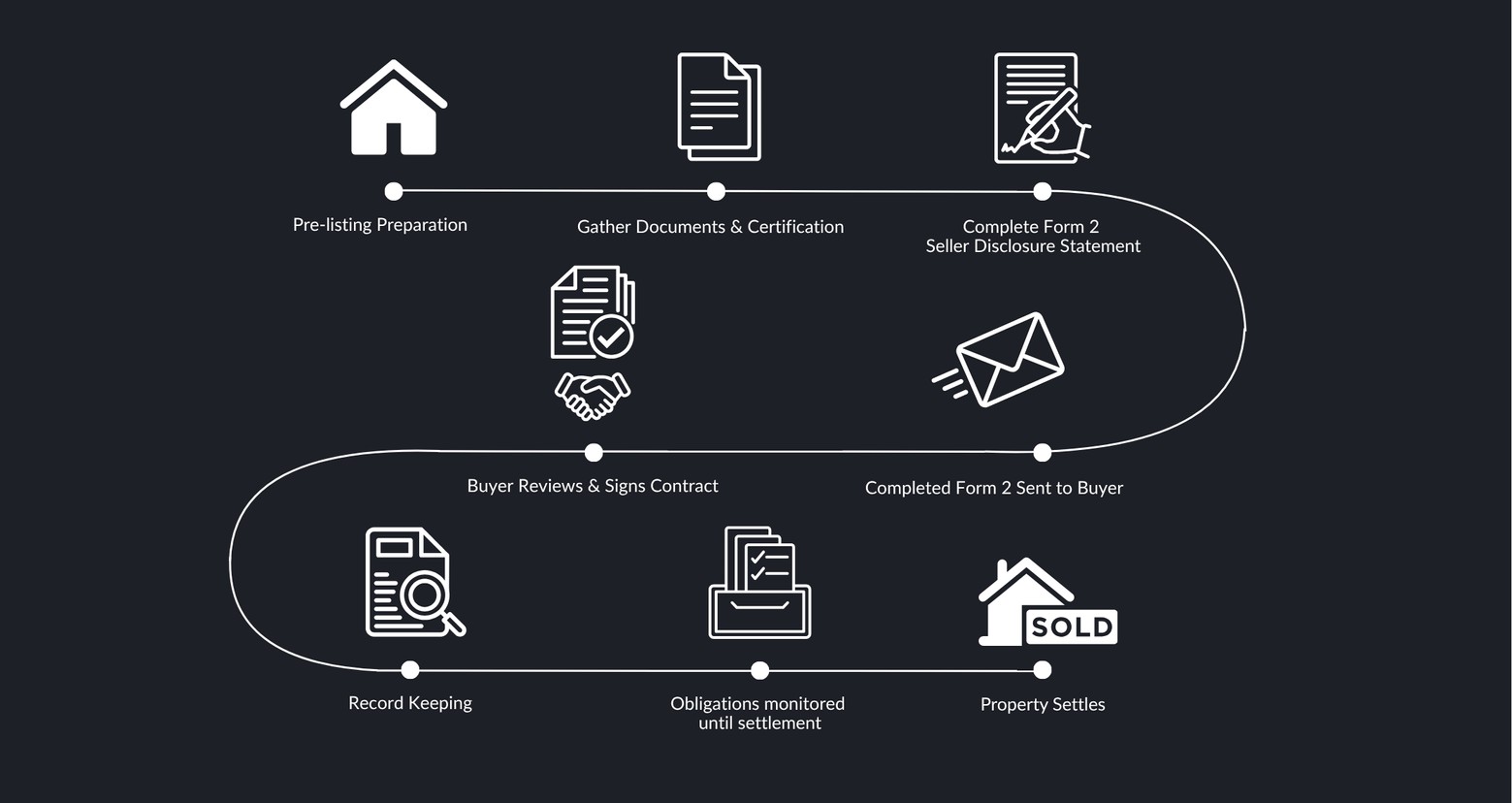

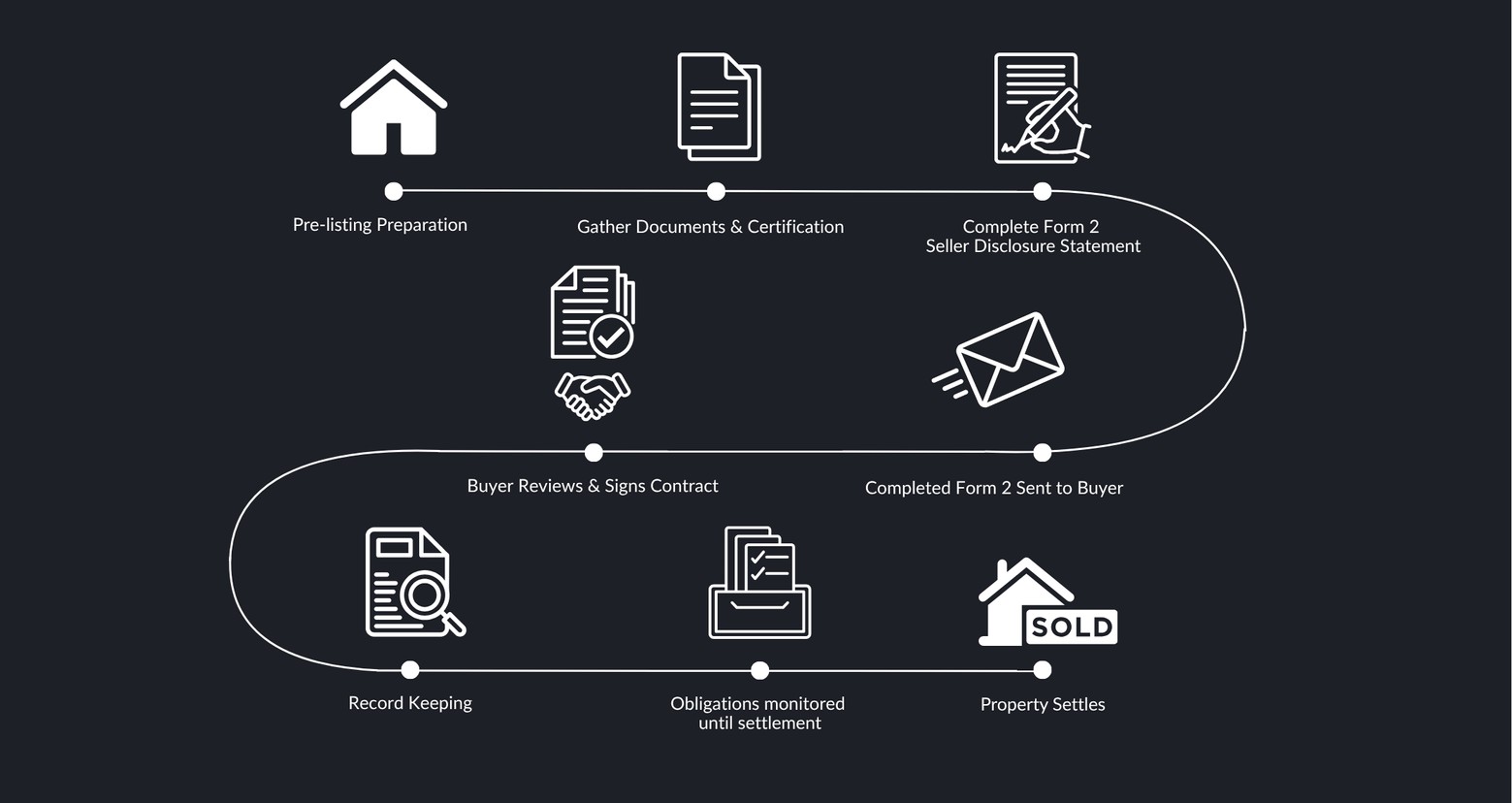

Under the new regime, sellers of most freehold residential property types in Queensland will be legally required to provide a prescribed disclosure statement (Form 2), along with supporting documentation, prior to the buyer signing the contract.

The disclosure statement must contain accurate and current information relating to the property, including but not limited to:

- A current title search

- A survey plan or registered plan of the land

- Zoning and local planning details

- Information about any encumbrances, easements or unregistered interests

- Tenancy details, if applicable

- Body corporate information, including by-laws and recent meeting minutes (for strata or community title properties

- Certificates or approvals, such as:

- Pool safety certificates

- Building approvals or final inspection certificate

- Infrastructure notices

- Flood or environmental hazard overlays

This disclosure must be provided before the contract is signed. If it is not, or if it is inaccurate or incomplete, the buyer may have the right to terminate the contract at any time before settlement, regardless of how far along the transaction has progressed.

What Happens If You Don’t Comply?

Failing to meet the disclosure requirements can lead to serious legal and financial consequences:

Termination Rights: Buyers may terminate the contract before settlement if the disclosure is not made properly or is materially inaccurate.

Loss of Sale: You risk losing a committed buyer due to avoidable documentation errors or omissions.

Legal Exposure: You may face financial penalties or legal action if you fail to meet your disclosure obligations.

Delays in Settlement: Missing or incorrect disclosures can delay timelines, which can impact your onward plans.

What Are the Costs Involved?

Preparing a compliant disclosure package will involve both time and financial outlay. Costs may include:

- Solicitor or conveyancer fees to assist with completing Form 2 and verifying documents

- Title searches, body corporate records, and obtaining relevant certificates

- Survey plans and local authority reports

Estimated cost: $1,500 – $2,000 depending on the complexity of the property.

It’s worth noting that these obligations will apply even if your property is already on the market and unsold by 1 August 2025, or if the contract date falls on or after 1 August 2025. There will be no transitional grace period.

Timing Is Everything

If you’re considering selling in the near future, now is the time to weigh up whether it’s worth advancing your sale prior to this new legislation coming into effect. By doing so, you may avoid the additional cost, paperwork, and risk associated with the new disclosure regime — particularly if your property is ready to go to market now.

We strongly recommend discussing your options with both your agent and legal representative to ensure you’re best placed to navigate these changes and protect the integrity of your sale.